Mind Over Money: Negotiation Tips for Real Estate Closing

You’ve found a buyer, and the real estate closing is in sight. The finish line feels close, but this last stage can still be the most stressful. Inspection reports, appraisal results, and unexpected delays can test even the most patient seller.

Negotiations often feel personal when you have invested time, money, and care into your home. Staying clear-headed and following a strategic plan is the best way to reach the closing table with confidence.

These five negotiation tips will help you manage the process without sacrificing your peace of mind.

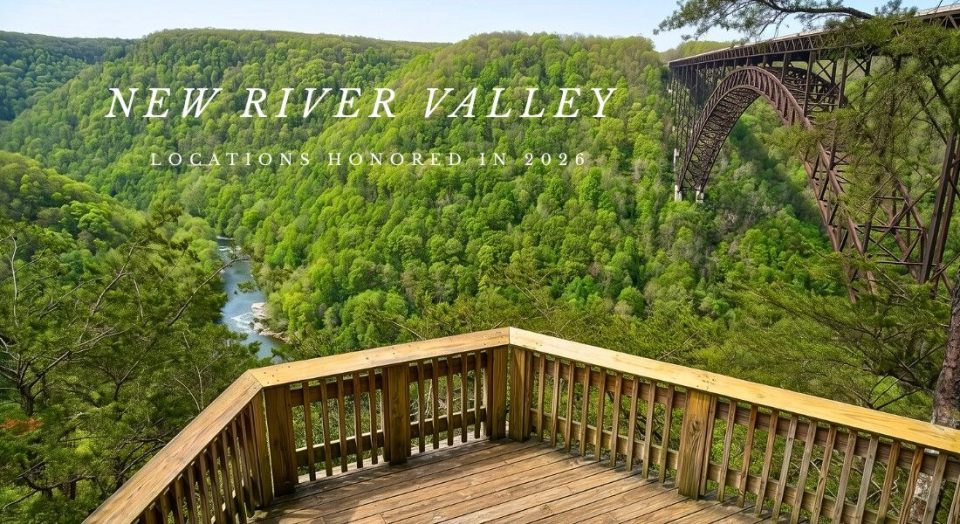

New River Valley Real Estate Market Watch

As of July 2025, the median days on the market for homes in Montgomery County was 12. However, NRV real estate trends are always changing. Contact The Louise Baker Team for help buying and selling homes in Virginia’s New River Valley.

5 Negotiation Tips for a Successful Real Estate Closing

1. Address Post-Inspection Requests Strategically

Most buyers schedule a home inspection after signing the contract. The report may reveal minor cosmetic concerns or significant repairs. Avoid taking these findings personally.

Work with your real estate agent to focus on repairs that affect safety, structure, or functionality. Cosmetic issues rarely justify major concessions. You typically have three choices: agree to the repairs, reject them, or offer a compromise such as a credit toward closing costs. Let your agent guide you in weighing repair costs against the risk of losing the buyer.

2. Resolve Appraisal Gaps with Market Insight

An appraisal gap occurs when the appraised value is lower than the agreed price. That is common in competitive markets and can stall negotiations if not handled quickly.

Consider three main options: lower the price, ask the buyer to pay the difference, or split the gap. The right move depends on market conditions, your timeline, and buyer motivation. Use your agent’s market analysis to decide whether to stand firm or make a small concession to keep the deal moving.

3. Overcome Delays with Consistent Communication

Even well-prepared sales can face slowdowns due to title issues, lender backlogs, or missing documents. These setbacks are often temporary, but you can typically resolve them with communication.

Stay in close contact with your agent, who can keep all parties on track and updated. Consistent updates reduce frustration and help maintain focus on closing.

4. Negotiate Repairs Without Losing Momentum

Prolonged negotiations over repairs can slow the process and damage goodwill. Instead of digging in your heels, look for solutions that keep the deal alive.

Ask your agent how they’ve handled similar transactions with repair requests. Offering a reasonable compromise can preserve buyer confidence, shorten discussions, and protect your closing timeline.

5. Know When Walking Away Protects Your Interests

Sometimes the most strategic move is to step back. If the buyer’s demands become excessive, continuing may not align with your goals.

Your agent can help you evaluate whether better opportunities exist in the current market. While walking away is difficult, it can save you time, money, and stress in the long run.

Frequently Asked Questions

Can a seller back out after accepting an offer?

Yes, but only under certain conditions stated in your contract. Backing out without legal grounds could result in penalties or a lawsuit. Always consult your agent and an attorney before making this decision.

What is the difference between closing costs and repair credits?

Closing costs cover transaction expenses like title fees and lender charges. Repair credits are funds given to the buyer at closing to cover needed repairs instead of doing the work yourself.

Do I need a lawyer during closing negotiations?

While not required in every state, having a lawyer can provide legal protection, ensure contract terms are fair, and prevent costly mistakes.

Partner with Experts Who Protect Your Bottom Line

The Louise Baker Team guides sellers through every stage of the closing process. Our negotiation expertise and market knowledge give you the clarity to make timely, smart decisions.

Are you considering buying or selling a home in the New River Valley area? We’d love to help you! Connect with us today and start your next chapter with a winning strategy.

<