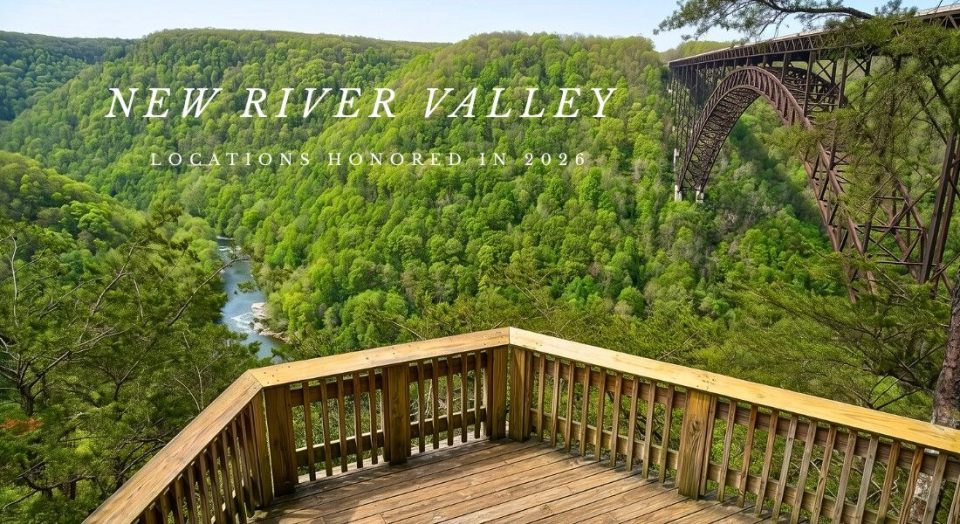

Land Banking Explained and Why the New River Valley Is Ideal for It

Have you ever wondered how some investors profit from land without developing it right away? That’s where land banking comes in. Many see the rising cost of real estate and wonder if there’s still room to make land investments.

In Virginia’s New River Valley, that potential is taking shape. With steady population growth, expanding infrastructure, and still-affordable parcels, the area offers opportunities people often overlook.

Read on to get land banking explained simply and see why the New River Valley could be one of the most strategic places to start.

New River Valley Real Estate Market Watch

As of September 2025, homes in Montgomery County sold after an average of 26 days on the market. However, NRV real estate trends are always changing. Contact The Louise Baker Team for help buying or selling a home in Virginia’s New River Valley.

Understanding How Land Banking Works

What Land Banking Really Means

Land banking involves purchasing undeveloped property and holding it for future appreciation rather than immediate development. Investors look for areas showing economic growth, infrastructure expansion, or population gains. When those trends push demand upward, the land’s value naturally increases.

In practical terms, it’s about identifying the next growth corridor, then getting in early while prices remain affordable.

Why are More Investors Turning to Land Banking?

Land banking offers several benefits:

- Affordability: Undeveloped land costs less, lowering entry barriers.

- Flexibility: Owners can choose when to sell or develop.

- Long-Term Appreciation: As communities grow, well-located parcels often gain value faster than the average home.

- Diversification: It adds a tangible, inflation-resistant asset to a portfolio.

Managing Potential Risks

Every investment has risk, and land banking is no exception. Carrying costs such as taxes and insurance add up. Zoning changes or delayed development plans can extend your holding period. Liquidity may be limited since raw land typically takes longer to sell. Still, with careful due diligence and realistic timelines, those challenges are manageable.

Why Location Matters in Land Banking

Traits of a Strong Land-Banking Region

Smart investors look for specific regional indicators before committing to land:

- Consistent population and job growth

- Expanding infrastructure, like roads and utilities

- Affordable land relative to the surrounding metro areas

- Favorable zoning and development outlooks

- Available parcels with access to transit and community hubs

A location that meets most of these conditions often provides the stability and appreciation that investors want.

The New River Valley Advantage

A Region With Measurable Growth

Many areas in the New River Valley continue to grow faster than many parts of Virginia. Recent data shows the NRV economy expanding about 3.7 percent in 2023, making it the second-fastest-growing region in the state. The population is increasing steadily, and home values have followed.

Economic Anchors Driving Demand

Virginia Tech and Radford University anchor the local economy, supplying talent and innovation that draw businesses and support steady housing demand. Tech-related startups, manufacturing expansion, and renewable-energy projects also strengthen the economic base. Together, these forces contribute to a healthy environment for long-term land appreciation.

Infrastructure and Quality-of-Life Appeal

Improving road networks, broadband expansion, and small-business development have increased the region’s accessibility. Meanwhile, outdoor recreation, cultural amenities, and a lower cost of living continue to attract professionals, students, and retirees. Those demographic shifts signal future demand for both housing and commercial land, which are key drivers for land banking returns.

Why the Time Is Right for Land Banking in the NRV

Affordable Entry, Solid Growth

Land prices in the NRV remain lower than Virginia’s statewide median, offering investors room to grow before the next market upswing. The mix of urban convenience and open acreage provides options for both residential and mixed-use potential.

Proven Market Activity

The number of days homes stay on the market indicates that demand is healthy and sustained. That movement suggests land in nearby corridors could appreciate as development pushes outward from core towns like Blacksburg and Christiansburg.

Strong Long-Term Fundamentals

The NRV’s educational ecosystem, research-based economy, and infrastructure projects suggest stable, future demand. Investors entering today can position themselves before competition increases.

Steps to Begin Land Banking in the New River Valley

1. Identify the Right Parcel

Look for undeveloped plots near growth areas with road access and basic utilities. Parcels within reach of Montgomery County or Radford offer strong potential.

2. Review Zoning and Environmental Factors

Confirm land-use designations and check slope, soil, or flood-risk data. Thorough research prevents costly surprises later.

3. Estimate Holding Costs and Potential Appreciation

Factor in taxes, insurance, and maintenance. Compare current land prices with nearby developed lots to gauge realistic future value.

4. Create Your Exit Plan

Set a time horizon (often 5 to 10 years) and decide whether to sell to developers, subdivide, or hold until rezoning increases value.

5. Track Regional Signals

Monitor employment growth, infrastructure projects, and housing demand metrics. The NRV’s expanding economy and low inventory provide early clues for timing your exit.

Land Banking Explained: Common Questions From NRV Investors

How long should I hold land for the best return?

Most investors plan a five-to-ten-year horizon. Actual timing depends on infrastructure completion and buyer demand.

Is raw land financing available in this area?

Yes. Several regional banks and credit unions offer land loans, though the terms differ from those of traditional mortgages. Larger parcels may qualify for commercial financing.

Can I develop part of the property while holding the rest?

If zoning allows, yes. Some investors choose to subdivide or sell a portion to cover holding costs while keeping the remainder for appreciation.

What makes the NRV different from other Virginia markets?

It offers the balance of affordability, economic vitality, and educational infrastructure rarely found together. Those elements create both stability and upside potential.

What risks should I prepare for?

Mainly liquidity and holding-cost risks. Working with local experts helps mitigate both by identifying properties with strong resale appeal and low maintenance needs.

Start Exploring Land Opportunities in the NRV

If you’re interested in long-term property investment, the New River Valley offers exceptional potential. The combination of affordability, economic strength, and growing demand makes it a smart place to start your land-banking journey.

Connect with The Louise Baker Team to explore available parcels, zoning insights, and local investment trends. With deep local knowledge and decades of experience, our team can help you make a confident, well-informed investment decision.