How 2026 Interest Rate Expectations Are Shaping NRV Buyers Now

2026 interest rate expectations are already influencing how New River Valley buyers plan, budget, and time their home purchases. Many buyers assume meaningful rate relief is coming soon, and that assumption shapes decisions long before any official changes occur.

Mortgage rates remain elevated compared to pre-2020 levels, despite modest declines from 2024 highs. As of early 2026, the average 30-year fixed mortgage rate is in the low 6% range.

Buyers in the New River Valley experience these shifts differently from those in metro markets. Local prices remain more accessible, but monthly payments still determine affordability and comfort.

This post explains how interest rate expectations are shaping NRV buyer behavior, financing strategies, and timing decisions using current data and local market context.

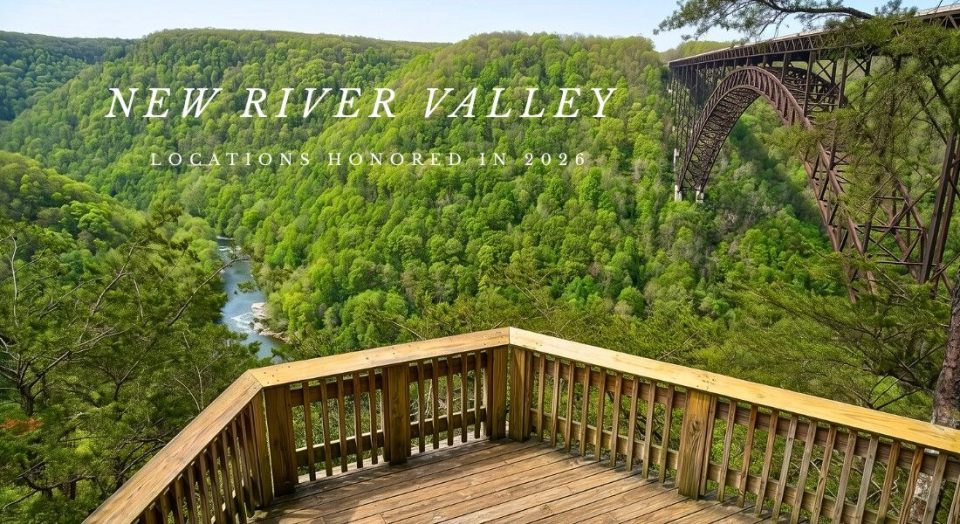

New River Valley Real Estate Market Watch

As of December 2025, the median price per square foot of homes in Christiansburg was $195. However, NRV real estate trends are always changing. Contact The Louise Baker Team for help buying or selling a home in Virginia’s New River Valley.

How 2026 Interest Rate Expectations Are Affecting NRV Buyers

What Current Rate Forecasts Actually Show

Most forecasts agree on direction but not speed. Rates are expected to ease gradually rather than fall sharply, according to leading housing economists.

Projections place 2026 mortgage rates between roughly 5.9 and 6.5 percent. Inflation moderation supports easing pressure, but elevated bond yields limit how quickly mortgage rates can decline.

Buyers waiting for a return to sub-five percent rates may wait longer than expected. Current forecasts suggest stability is more likely than a dramatic change.

Why Small Rate Changes Matter More in NRV

The New River Valley remains a price-sensitive market with wide income variation across Blacksburg, Christiansburg, Radford, and surrounding areas. Buyers here often anchor decisions to monthly payment comfort rather than maximum loan approval.

A half-point rate shift can meaningfully change affordability. For a buyer financing $350,000, that difference can alter monthly payments by several hundred dollars.

This impact affects confidence, not just qualification. Buyers in the NRV tend to budget conservatively, magnifying the impact of interest rate expectations.

Buyer Timing Decisions Are Shifting Earlier

Many buyers no longer wait for ideal conditions. Instead, they plan around realistic rate ranges supported by lender projections.

Pre-approvals increasingly reflect expected rate volatility rather than single assumptions. Buyers are more likely to lock rates earlier when payments align with their comfort zone.

This shift reflects lessons from 2023 and 2024. Waiting for rate drops often meant facing higher prices or reduced inventory later.

Inventory Trends Are Changing Buyer Leverage

Higher rates reduced listings earlier in the cycle, creating a lock-in effect. That dynamic is now easing as more homeowners hold mortgages above five percent.

Selling no longer feels like a financial setback for many households. As a result, Virginia housing data shows gradual inventory growth entering 2026.

For NRV buyers, increased selection improves leverage. More options support negotiation on price, repairs, and closing terms.

Financing Strategies Buyers Are Using Right Now

Buyers are adjusting the structure rather than just the timing. Financing decisions increasingly focus on reducing payment risk rather than on chasing lower rates.

Several strategies appear more frequently in NRV transactions. These approaches work best when aligned with realistic interest rate expectations:

- Larger down payments to offset borrowing costs

- Rate locks timed around contract milestones

- Seller credits used toward temporary or permanent buydowns

- Conservative price ceilings tied to payment comfort

Each strategy requires lender coordination and local market awareness. Generic national advice often misses the realities of NRV-specific contexts.

How Waiting for Later in the Year Could Help or Hurt Buyers

Waiting can help buyers if rates ease modestly while inventory expands. It can hurt if prices rise faster than borrowing costs decline.

The New River Valley has historically seen steady appreciation rather than sharp corrections. Significant price declines remain unlikely without broader economic disruption.

Buyers considering delays should evaluate monthly payment scenarios rather than focusing solely on rates. Affordability outcomes depend on multiple variables working together.

What This Means for First-Time and Move-Up Buyers

First-time buyers feel rate pressure most directly because payments drive approval and confidence. Small shifts often determine whether a purchase feels sustainable.

Move-up buyers face layered decisions involving selling, buying, and borrowing simultaneously. Many evaluate blended outcomes rather than isolating individual transactions.

Both groups benefit from realistic expectations grounded in current forecasts. Speculation increases risk without improving decision quality.

Questions NRV Buyers Ask About 2026 Interest Rates

Are mortgage rates expected to drop significantly in 2026?

Most forecasts point to gradual movement rather than sharp declines. Rates near historical averages appear more likely than dramatic drops.

Should buyers wait for lower rates before purchasing?

Waiting only helps if rates fall faster than home prices rise. That balance depends on property type, location, and timing.

How do interest rates affect NRV home prices?

Higher rates slow demand but rarely reverse long-term pricing trends. Limited supply continues to support values across the region.

Can buyers refinance later if rates improve?

Refinancing may be possible, but it is never guaranteed. Buyers should qualify based on current affordability, not future assumptions.

Planning Ahead With NRV Homes

Interest rate expectations affect more than timing. They shape loan options, price range, and long-term affordability.

Local guidance helps buyers connect rate forecasts to real purchase decisions. That clarity matters when you are choosing between waiting, moving forward, or adjusting expectations.

NRV Homes works with buyers planning purchases across the New River Valley. We help evaluate financing options, timing considerations, and negotiation strategies based on current market conditions.

Planning to buy in 2026? If interest rates are part of your strategy, connect with us today! We can help you make sense of the current market.