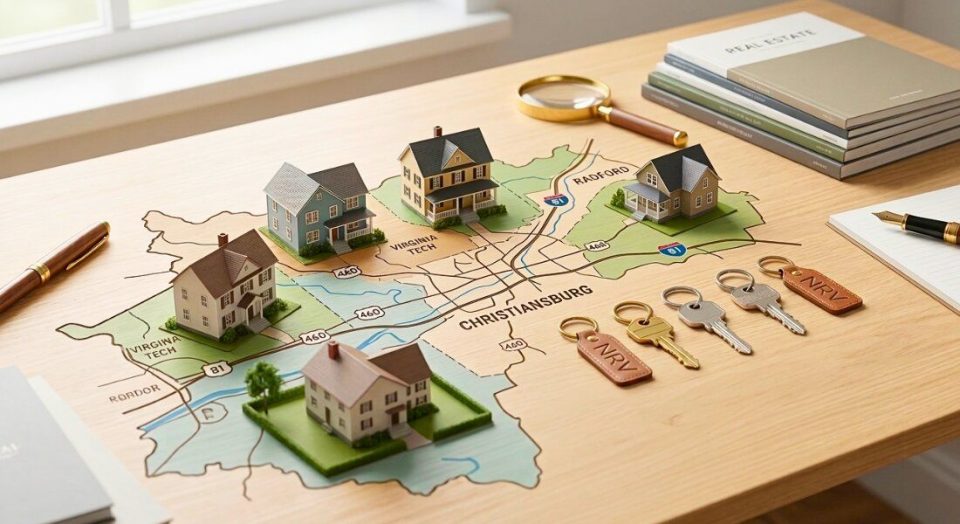

How To Qualify for Your NRV Home Mortgage

Getting your first NRV home mortgage is a huge milestone in your life. Due to the high cost of buying a home, it is often viewed as the only method of financing this purchase.

However, getting approved for a mortgage can be difficult and frustrating for many people. In fact, it often takes days or weeks of back and forth with banks to finally get fully approved.

Luckily, there are many things you can do to better your chances of getting approved for a home mortgage. Here are seven tips you can try.

7 Tips To Have Your NRV Home Mortgage Approved

1. Start Financial Planning In Advance

Planning your finances is a good idea, especially important if you’re planning to apply for a mortgage. You can start saving money now by cutting back on unnecessary expenses, paying off debt, and saving up so that you’ll have enough money to cover the down payment.

2. Get Prequalified Before You Start Looking

Prepare to buy a home by getting pre qualified before you start looking so you will know exactly what your budget is. You’ll need money for the down payment, closing costs, inspections and other miscellaneous expenses. Make sure you work with a lender you trust and who will walk you through the loan process step by step. If you don’t know a lender, we can refer one to you through our network of professionals. Click here for our contact page.

3. Consult A Mortgage Broker or A Financial Advisor

Start planning your financial future as early as possible. It is important to speak with a professional who can offer you advice and counsel on the right course of action. A mortgage broker will be able to help you with figuring out how much you can borrow/afford.

4. Check and Improve Your Credit Score

Your credit score is an indicator of your financial responsibility used by lenders to decide whether or not to approve your application. Poor credit scores can limit your loan eligibility and increase your interest rate. Good credit and larger down payments will allow you to borrow more and save money with a lower interest rate.

5. Address Any Credit Score Errors

Make sure you check your credit report carefully once you receive it. If you plan to shop for a mortgage soon, it’s a good idea to review your credit report six months before your application, so you have time to correct any errors. Contact your credit reporting agency as soon as possible if you find errors on your report.

6. Lower Your Debt-to-Income Ratio

When you apply for a mortgage, the lender will factor in your debt-to-income ratio. Once you obtain beyond 43%, then you will be considered a risky borrower and could be denied a mortgage. Lowering your debt can improve your chances of getting financing.

7. Increase Your Loan-To-Value Ratio

A larger down payment will lower your loan-to-value ratio. If put down $40,000 for a $100,000 house, your mortgage will now be just $60,000. As a result, the loan-to-value ratio will drop which will lower the loan amount. This will result in lower monthly payments and less interest over the life of the loan.

Tighter lending practices have made it more difficult to qualify for a home mortgage. The good news is that you can take steps to improve your chances of qualifying for a loan by following the above-mentioned tips.

Moving to a new area can be stressful but planning makes it much easier. If you’re looking for a home, you want to work with a Realtor who has a lot of experience in the area. Louise has over 30 years selling homes in New River Valley. If you’re looking for a new home, please click here to contact Louise. She’ll take a lot of stress off your plate.