How Are Homeowners in Montgomery County Benefiting from Rising Home Values?

Home values in Montgomery County, Maryland, continue to rise steadily, and homeowners can enjoy various advantages. With the average value of homes in Montgomery County rising by more than 21% in March 2023 from the previous year, it’s unsurprising that residents may feel financially secure and confident in their investments. Let’s explore how homeowners in Montgomery County can benefit from the housing market’s current state.

4 Ways Homeowners In Montgomery County Can Take Advantage Of Rising Home Value

Increased Equity

One of the primary ways of benefiting from raised home value is through increased equity. Whenever home values continue to rise, homeowners can find themselves with a more significant stake in their properties than ever before.

Equity is the difference between the current market value of a property and the amount of money still owed on its mortgage. As property values rise, homeowners’ equity in their properties also increases. This increase in equity gives homeowners more financial flexibility, allowing them to access funds.

For example: Refinancing your mortgage is one way to access your home’s equity.

By refinancing, you can take advantage of lower interest rates and potentially lower your monthly payments. Additionally, a cash-out refinance allows you to borrow against the equity in your home and use the funds for home improvements, debt consolidation, or other expenses. The extra cash can be a game-changer for homeowners who need a financial boost.

Feeling More Secured

Being a homeowner in Montgomery County has its perks, including the potential for a better quality of life. As property values rise, homeowners will be more financially secure. From renovations to debt reduction to savings, the benefits of homeownership in a high-value house can positively impact your overall well-being.

Lower Interest Rate

Rising home values could lead to some significant savings on your mortgage. The higher home values can also lead to considerable savings in the long run. One of the most common ways this can happen is through lower mortgage interest rates. Click here to learn more!

Higher Resale Value

Higher home values can make your property more desirable and increase your chances of selling your home for a higher price down the road!

Additionally, due to the low cost of living in Montgomery County and its abundance of colleges and universities, there is a robust demand for rental housing. Homeowners can leverage this opportunity by renting properties and generating a steady cash flow.

There is no doubt Montgomery County homeowners can benefit from the current state of the housing market. From increased equity and the potential for higher resale value to the impact on local businesses and the creation of job opportunities, the rise in home value can significantly affect the community.

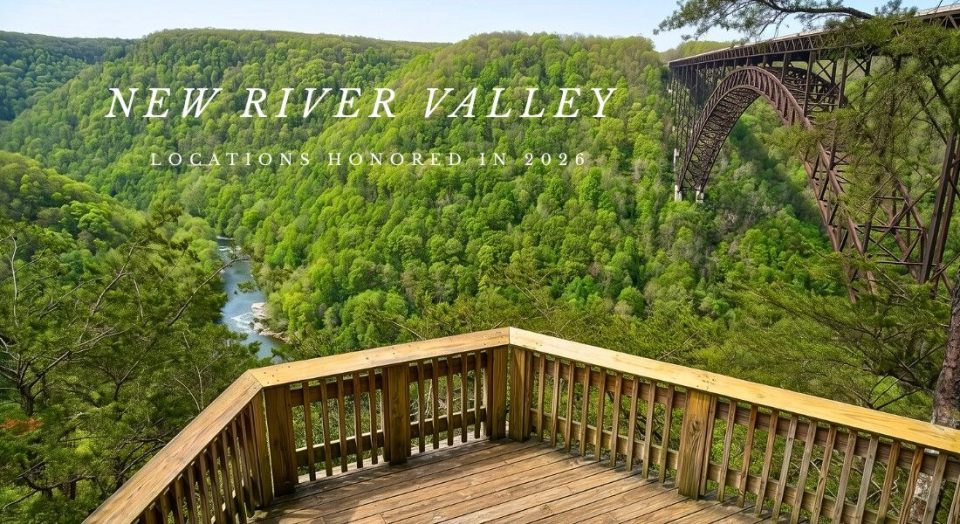

New River Valley Homes

Are you considering buying or selling a home in the New River Valley area? We’d love to help you! Please click here for our contact page, and we’ll reach out to you promptly.

Would you like to see more great info from NRV Homes? Please click here for our blog page.

Thanks for visiting!