How to Avoid Overpaying in NRV Neighborhoods

You found the perfect house. It checks every box. Three other families want it too, and the agent just told you offers are due by noon tomorrow. You have less than 24 hours to decide how much you’re willing to pay for a home you’ve seen once.

That pressure leads to expensive mistakes. Overpaying affects more than your monthly payment. It impacts appraisal risk, equity building, and long-term financial flexibility.

Even in Southwest Virginia, homes regularly sell at or above list price during high-demand periods. Understanding how pricing actually works is your best protection against buyer’s remorse.

This post explains how buyers can avoid overpaying in NRV neighborhoods.

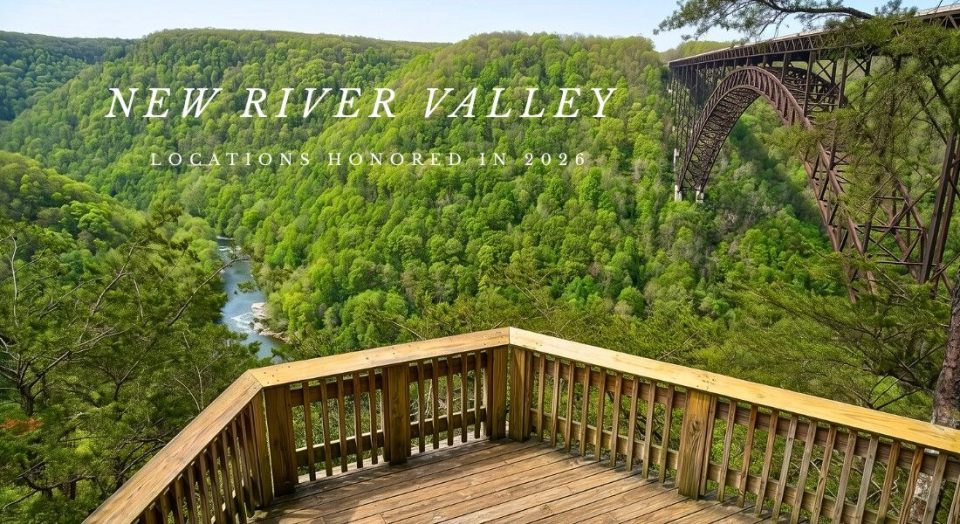

New River Valley Real Estate Market Watch

As of December 2025, the median home sale price in Pulaski County was $190,000. However, NRV real estate trends are always changing. Contact The Louise Baker Team for help buying or selling a home in Virginia’s New River Valley.

Avoid Overpaying in NRV Neighborhoods With Local Market Awareness

Why Pricing Pressure Feels Different in the New River Valley

Pricing behavior in the New River Valley does not follow national patterns. Demand concentrates in specific areas rather than evenly across the region. Inventory also remains tight in many established neighborhoods.

Several factors drive this dynamic. Virginia Tech and Radford University create steady demand for housing. Healthcare and tech employment continue to expand. Buyers relocating from higher-cost regions often bring stronger purchasing power.

Local MLS reports show that some neighborhoods sell far faster than the regional average. Those averages can mislead you. Overpaying often begins when buyers rely on broad statistics rather than neighborhood-level data.

Which Neighborhoods Create the Most Overbidding Risk

Some NRV neighborhoods attract consistent competition. These areas share common traits. Supply stays limited. Demand remains steady. Buyers compete for similar homes.

This pattern appears near major employers, school zones, and commuter routes. Established Blacksburg neighborhoods sell quickly due to low turnover. Parts of Christiansburg attract buyers seeking newer homes and easier access. Radford neighborhoods near campus support demand year-round.

Each neighborhood behaves differently. Treating the NRV as one market increases the risk of overpaying.

Market Value Versus What Buyers Feel in the Moment

Market value comes from closed sales. Emotional pricing comes from competition. In strong markets, those two numbers drift apart.

Multiple-offer situations push buyers beyond supported pricing. Appraisals then become a problem. Lenders rely on recent comparable sales, not bidding intensity.

Federal Housing Finance Agency standards remain conservative. When an appraisal comes in low, buyers often cover the gap with cash or renegotiate the terms. Both outcomes add stress. Knowing where value truly sits helps you avoid that position.

Using Sale-to-List Ratios to Ground Your Offer

Sale-to-list price ratios show how aggressive buyers are. Ratios above 100 percent signal consistent overbidding. This metric matters more than the asking price.

Local MLS data often shows higher ratios in competitive NRV neighborhoods. Slower areas usually stay closer to the list price. Absorption rates add another layer. Faster absorption means fewer choices and more pressure.

These numbers only work when reviewed at the neighborhood level. Regional averages hide important differences.

Why Escalation Clauses Often Push Prices Too Far

Escalation clauses feel protective, but they often work against you. Sellers design listings to trigger higher automatic offers.

Escalation can reveal your maximum price. It can also push you beyond the scope of appraisal support. In many NRV transactions, buyers pay more than necessary because the next offer sat much lower.

Strong offers do not always require escalation. Pricing discipline matters more than speed alone.

Timing Strategy Without Trying to Predict the Market

Trying to time the market usually backfires. Timing your preparation works better.

NRV demand often peaks in spring and early summer. Competition softens during fall and winter. Academic calendars influence buyer behavior more than interest rate headlines.

Freddie Mac data shows that rate drops often increase buyer demand. More buyers rarely lead to lower prices. That means preparation is more effective than timing.

How Repairs and Inspections Change the Cost Equation

Overpaying extends beyond the contract price. Waiving protections increases long-term risk. Many NRV homes include aging systems or rural infrastructure.

Wells and septic systems require maintenance. Drainage issues appear on sloped lots. Older HVAC and roofing systems raise future costs.

Housing data shows repair costs continue rising. Stretching on price limits your ability to handle these expenses comfortably.

Why Local Guidance Changes Pricing Outcomes

Online estimates lack neighborhood context. Local professionals see pricing signals before they appear in public data.

Real estate agents track failed contracts, appraisal issues, and repeated relistings. They understand when demand is real and when pricing is higher than it should be.

That perspective helps you compete without overcommitting.

Questions Buyers Ask Before Offering in Competitive NRV Areas

How do I know if a price is supported?

Recent comparable sales in the same neighborhood provide the clearest answer. Look for similar size, condition, and location, not just properties anywhere in the county.

Is paying over the list price always wrong?

Not necessarily. Paying over list can make sense when recent sales data support that pricing level. Overpaying happens when your offer exceeds what the market can defensibly justify.

How common are appraisal gaps locally?

Appraisal gaps appear more frequently during peak buying seasons. Thorough pricing analysis before you offer reduces this risk significantly.

Should I waive contingencies to win?

Waiving protections increases your exposure to unforeseen problems. Each decision should reflect the property’s actual condition, your risk tolerance, and your financial cushion.

Buy With Confidence in the New River Valley

NRV Homes helps buyers evaluate pricing, comparables, and offer structure before decisions are final. Our approach focuses on clarity, not pressure. Buyers gain confidence without stretching beyond what the market supports.

If you are preparing to buy in a competitive NRV neighborhood, we can help you move forward with precision and perspective. Contact us today!